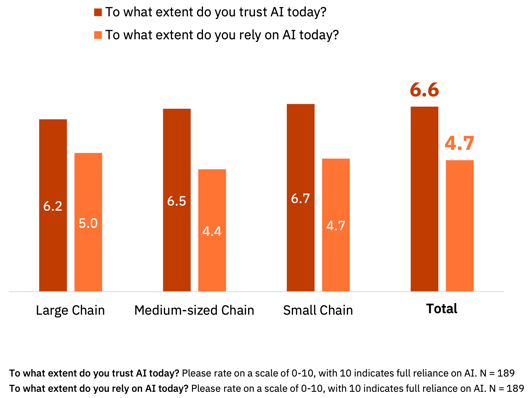

Hotels trust AI at 6.6 out of 10. But they only rely on it at 4.7 out of 10.

That 1.9-point gap, revealed in H2C's 2025 Global AI & Automation Study of 171 hotel chains, explains everything about why AI adoption in hospitality remains stuck despite massive investment.

We sponsored this research because we wanted to understand a pattern we'd been seeing: Properties investing heavily in AI features whilst struggling to actually operationalise them. The study confirmed what we suspected, this isn't a technology problem. It's an architecture problem.

Understanding the Trust-Reliance Gap

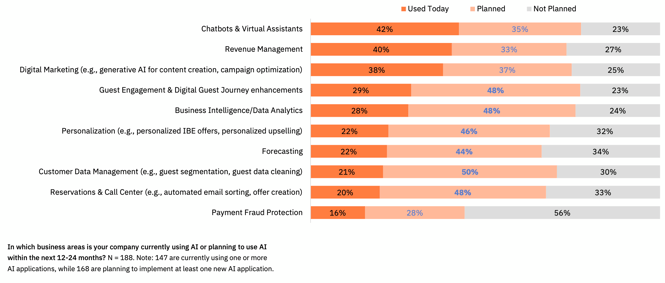

When 78% of hotel chains say they "use" AI, but only 16% have deployed personalised booking experiences, something fundamental is broken in the adoption process.

The study used Net Promoter Score methodology to analyse these trust and reliance scores, and the results are telling. A trust score of -30 indicates ongoing scepticism about reliability and data security. But a reliance score of -70? That shows weak confidence requiring immediate attention.

This isn't about hotels being overly cautious. It's about hotels being unable to prove value.

Source: h2c 2025 Global AI & Automation in Hospitality Study, sponsored by Profitroom

Here's the kicker: 42% of properties don't measure AI ROI at all. When you can't show whether something works, you can't justify relying on it, regardless of how much you trust the concept.

Why 70% Prioritise Integration Over Innovation

This is where the study gets really interesting for anyone evaluating booking engine options with AI capabilities.

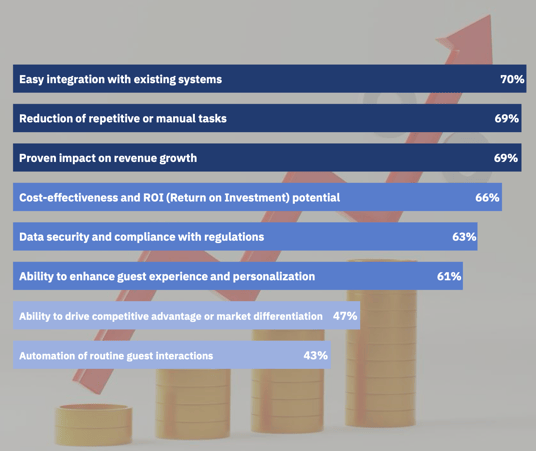

When decision-makers ranked what drives their AI purchasing decisions, "easy integration with existing systems" scored 70%, well ahead of:

- Reduction of manual tasks (69%)

- Proven revenue impact (69%)

- Cost-effectiveness and ROI potential (66%)

- Ability to drive competitive advantage (47%)

Innovation ranked at 47%. Let that sink in.

Source: h2c 2025 Global AI & Automation in Hospitality Study, sponsored by Profitroom

Hotels don't want cutting-edge AI. They want AI that works with their existing property management system, central reservation system, and revenue management system without creating integration nightmares.

The barriers confirm this pattern:

- 45% cite integration challenges with existing systems

- 41% face data quality and accessibility issues

- 32% struggle with cross-departmental data sharing

This creates a fundamental architecture question: Should your booking engine have AI features built in, or should you integrate specialised AI vendors?

The Platform Approach: Everything Built Into Your Booking Engine

The platform approach means choosing a booking engine with personalisation, upselling, and guest interaction features already built in, whether those features use AI or not.

The integration advantage: Instead of connecting three separate vendors (one for chatbots, one for personalisation, one for upselling) to your PMS/CRS/RMS, you're connecting one system. Fewer integration points means fewer things that can break.

Think about it: each vendor needs API connections, ongoing maintenance, and troubleshooting when something goes wrong. Multiply that by three, four, or five vendors, and you've created significant technical debt.

The measurement advantage: When your AI Agent, personalised offers, and upselling features all live in one booking engine, attribution becomes straightforward. Every interaction flows through one dashboard. You can see AI Agent conversation → booking attribution and personalised offer → booking conversion directly. No spreadsheet archaeology required.

This integrated architecture has been core to our booking engine from the start, eliminating the measurement complexity that keeps 42% of hotels from tracking ROI.

When three different systems touch each booking, how do you know which one deserves credit? Most hotels can't answer that question. It's not that they don't want to measure, they literally can't figure out which of their multiple vendors actually works.

Trade-offs: Each feature may be less specialised than best-of-breed alternatives. And you're dependent on one vendor's roadmap for all innovation. If they're slow to add a capability you need, you're stuck.

The Patchwork Approach: Specialised Vendors for Each Function

The patchwork approach means selecting best-of-breed vendors for each function, one for chatbots, another for personalisation, a third for upselling.

The capability advantage: Each vendor focuses exclusively on one problem, often delivering more sophisticated features than platform approaches. If you need truly advanced natural language processing in your chatbot, or highly sophisticated personalisation algorithms, specialised vendors may deliver more.

The flexibility advantage: You can swap individual vendors without replacing your entire booking engine. If a better chatbot vendor emerges, you swap out that one piece without touching personalisation or upselling.

Trade-offs: Each vendor needs separate API connections, separate contracts, separate support relationships. The complexity compounds. When multiple tools touch each booking, determining which drove conversion becomes a data science project rather than a dashboard glance.

The study shows this complexity is precisely what creates the trust-reliance gap. Hotels believe these specialised tools work (trust = 6.6) but can't operationalise them smoothly enough to fully rely on them (4.7).

The 2025 Personalisation Wave: Why Timing Matters

59% of hotel chains are implementing booking engine personalisation in 2025, up from just 16% in 2024. That's the highest year-over-year growth rate of any AI application in the study.

Source: h2c 2025 Global AI & Automation in Hospitality Study, sponsored by Profitroom

Compare this to AI-driven pricing recommendations, which barely moved, only 1% combined growth in usage and planning despite high interest.

Why the difference? Personalisation creates immediately visible conversion lift. AI pricing requires revenue management expertise to evaluate whether it's actually working.

The 59% implementing personalisation this year will split into two groups by 2026:

- Those running it at scale with clear ROI measurement

- Those still troubleshooting integration issues

Your architecture choice, platform or patchwork, largely determines which group you'll be in. Our Personalised Offers feature has been helping hotels increase conversion for years.

What We Learnt Deploying Our AI Agent

Earlier this year, we rolled out Profitroom AI Agent. Personalised offers and upselling have been part of our platform for years. But AI Agent was new.

The impact of having it natively integrated into our Booking Engine 360 was immediate. Every interaction flows through one dashboard.

We can clearly see:

- AI Agent conversation → booking attribution

- Personalised offer sent → booking conversion

Here’s the surprise: the biggest value wasn’t what we expected. We thought booking completions would dominate. Instead, the real win was moving enquiries straight into the booking flow.

Instead of handing conversations back to staff, AI Agent takes action:

- Dropping a Book Now button into chat to push guests directly into the Booking Engine.

- Sending a personalised email offer with live pricing and availability.

That shift is saving properties 80+ staff hours per month. And this is where the difference between chatbots and AI agents really matters. As the study highlights: assistants react, agents act. Chatbots answer questions while an AI Agent sells.

This maps directly to the study’s finding that 62% of hotel chains cite a lack of AI expertise as their top barrier. With AI Agent, hotels don’t need expertise. The system shows its own impact in the dashboard, no manual tracking required.

AI Agent is our newest addition to Booking Engine 360, which also includes Personalised Offers and unified reporting through one dashboard.

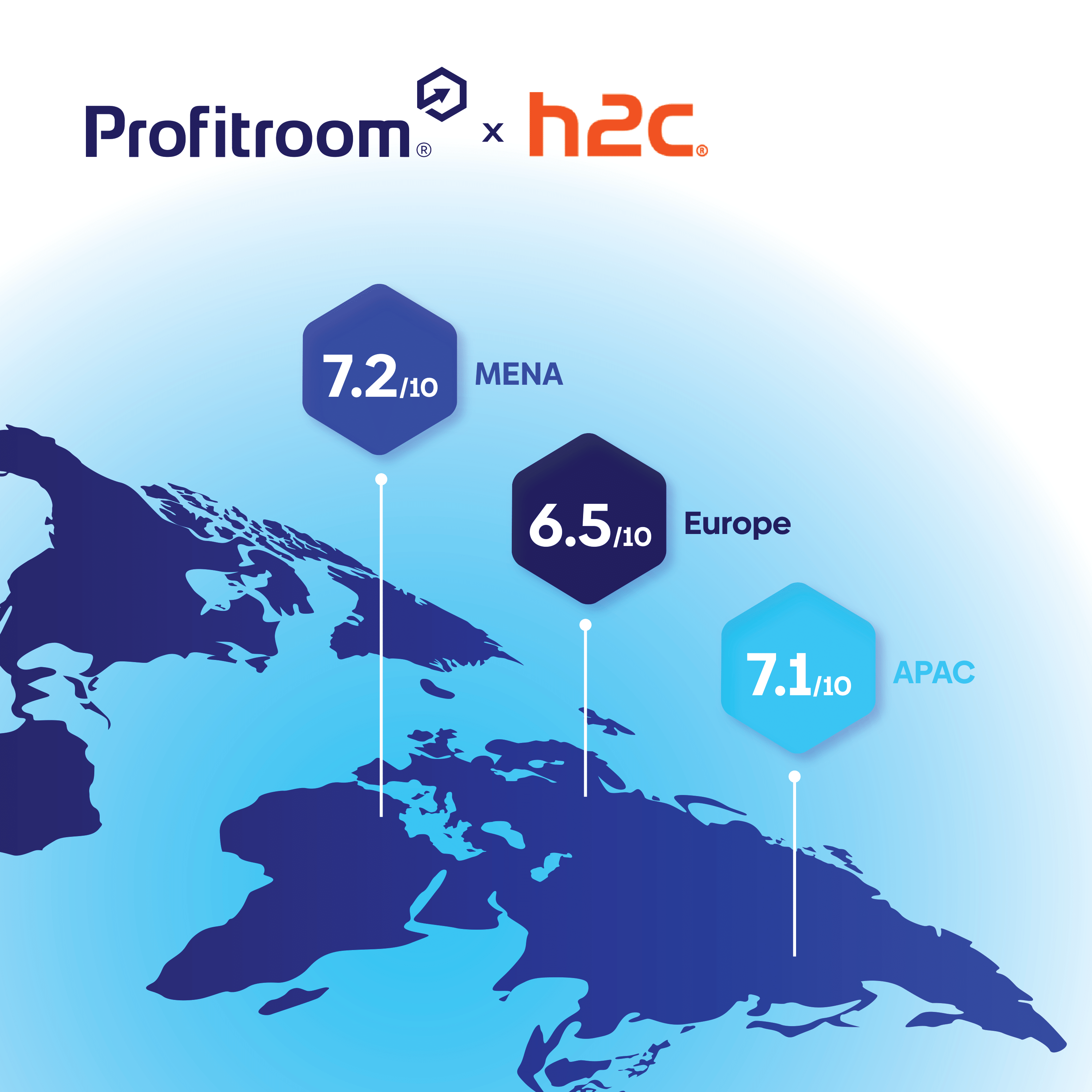

Regional Patterns Matter

The study's regional breakdown reveals different AI confidence levels that should inform your vendor selection:

MENA (Middle East & Africa): 7.2/10 confidence, Highest globally. Execution-first mindset, learning by doing rather than planning by committee. These properties are ready for platform approaches that deploy quickly.

Europe: 6.5/10 confidence, 85% lack formal AI strategy, 43% cite data barriers. Risk of analysis paralysis. These properties need turnkey solutions with clear proof points.

Asia Pacific: 7.1/10 confidence, Strong preference for 1-to-1 personalisation over traditional segmentation. AI features must feel premium, not generic.

Your region's readiness level should influence whether you prioritise simplicity (platform) or sophistication (patchwork).

Making the Architecture Decision

Neither approach is universally correct. Your choice depends on resources and priorities.

Choose platform approach if: Integration resources are limited, you need clear ROI measurement from day one, speed to value matters more than feature depth, or your team has limited AI expertise.

Choose patchwork approach if: You have dedicated IT resources for integration, you need best-in-class capability for each function, you can build custom measurement dashboards, or feature specialisation outweighs integration complexity.

Warning signs you're choosing wrong: With platforms, if you constantly need more sophisticated individual features. With patchwork, if your implementation timeline extends beyond 90 days.

The study shows 89% are implementing AI this year, but only 8% have formal strategies. Strategy isn't the blocker, choosing the right architecture for your resources is.

The Window Is Closing

The trust-reliance gap will close in 2025 for properties that solve integration first. The 59% implementing personalisation now are setting the benchmarks everyone else will chase in 2026.

By then, the question won't be whether your booking engine should have AI features. It'll be why you're still manually creating offers whilst competitors let AI handle it.

The architecture decision you make today determines whether you're setting those benchmarks or chasing them.

Evaluating your booking engine options? We're happy to discuss what we learnt deploying our AI agent,what worked, what didn't, and what genuinely surprised us. Schedule 15 minutes

Building a Future Ready Hotel starts with the right architecture decisions.

Based on h2c's 2025 Global AI & Automation in Hospitality Study.

-Mar-11-2025-10-07-16-4716-AM.jpg?width=2000&name=Reception%20with%20Guest_00125%20(3)-Mar-11-2025-10-07-16-4716-AM.jpg)

.png?width=531&height=427&name=Grafiki%20GB%20%E2%80%93%201200x645%20(2).png)